Orange Ca Sales Tax Rate 2024

Orange Ca Sales Tax Rate 2024. Look up 2024 sales tax rates for orange, california, and surrounding areas. 81 rows the local sales tax rate in orange county is 0.25%, and the maximum rate.

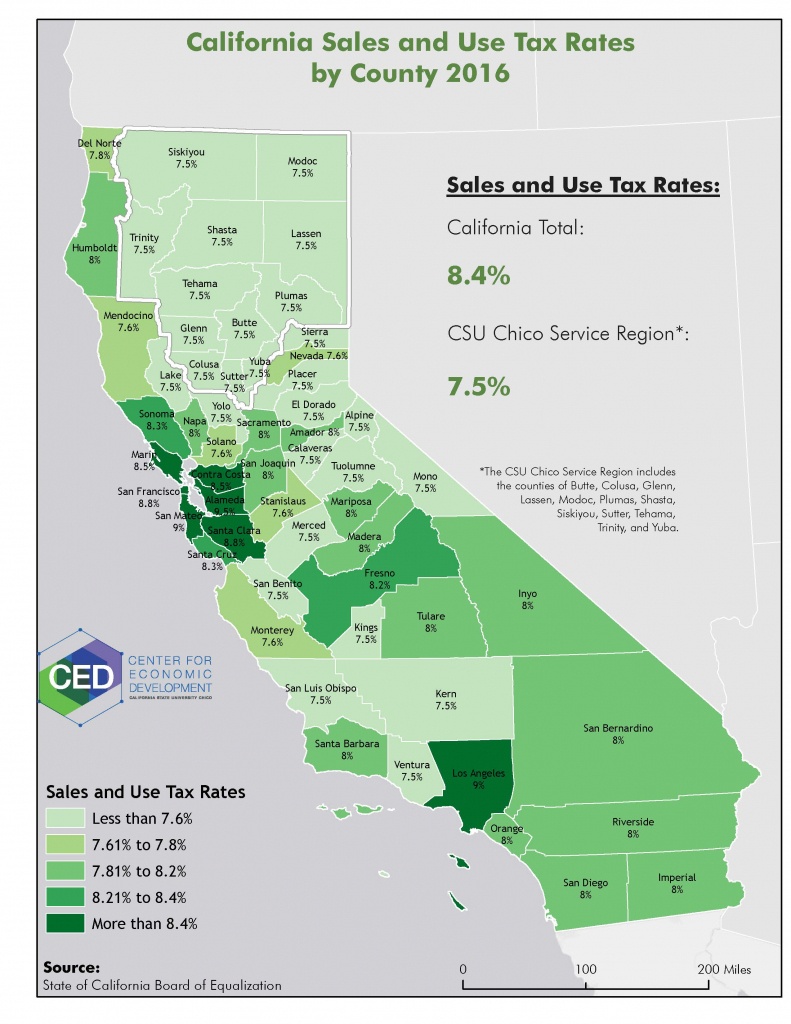

The average cumulative sales tax rate in orange county, california is 8.23% with a range that spans from 7.75% to 10.25%. 2024 california sales tax table.

Combined With The State Sales Tax, The Highest Sales Tax Rate In California Is 10.75% In The Cities Of Hayward, San Leandro, Alameda, Union City And Fremont (And Ten Other Cities).

California sales and use tax rates in 2024 range from 7.25% to 10.25% depending on location.

The Orange County Sales Tax Calculator Allows You To Calculate The Cost Of A Product (S) Or Service (S) In Orange County, California Inclusive Or Exclusive Of Sales Tax.

2024 california sales tax table.

Look Up 2024 Sales Tax Rates For Orange, California, And Surrounding Areas.

Images References :

Source: printablemapaz.com

Source: printablemapaz.com

Sales Taxstate Here's How Much You're Really Paying California Sales, The 7.75% sales tax rate in orange consists of 6% california state sales tax, 0.25% orange county sales tax and 1.5% special tax. The current sales tax rate in orange county, ca is 10.25%.

Source: printablemapaz.com

Source: printablemapaz.com

Sales Taxstate Here's How Much You're Really Paying California Sales, Orange, ca sales tax rate. Type an address above and click search to find the sales and use tax rate for that location.

Source: napavalleyregister.com

Source: napavalleyregister.com

New California city sales tax rates take effect on April 1, These figures are the sum of the rates together on the state, county, city, and special levels. The orange county, california sales tax is 7.75%, consisting of 6.00% california state sales tax and 1.75% orange county local sales taxes.the local sales tax consists of a 0.25%.

Source: www.lao.ca.gov

Source: www.lao.ca.gov

Understanding California’s Sales Tax, Orange, ca sales tax rate. Combined with the state sales tax, the highest sales tax rate in california is 10.75% in the cities of hayward, san leandro, alameda, union city and fremont (and ten other cities).

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, The current sales tax rate in orange, ca is 7.75%. Find a sales and use tax rate.

![California Sales Tax Rates Vary by City and County [EconTax Blog]](https://lao.ca.gov/Blog/Media/Image/353) Source: lao.ca.gov

Source: lao.ca.gov

California Sales Tax Rates Vary by City and County [EconTax Blog], Combined with the state sales tax, the highest sales tax rate in california is 10.75% in the cities of hayward, san leandro, alameda, union city and fremont (and ten other cities). Every 2024 combined rates mentioned above are the results of california state rate.

Source: taxfoundation.org

Source: taxfoundation.org

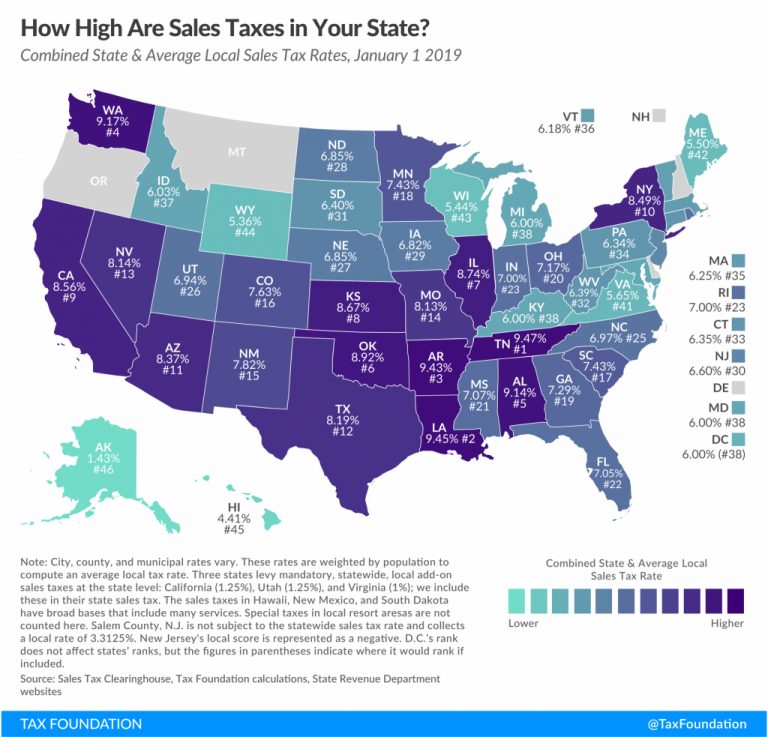

2022 Sales Tax Rates State & Local Sales Tax by State Tax Foundation, 546 rows california city & county sales & use tax rates (effective april. Use our calculator to determine your exact sales tax rate.

Source: www.lao.ca.gov

Source: www.lao.ca.gov

Understanding California’s Sales Tax, The december 2020 total local sales tax rate was also 7.750%. Our free online california sales tax calculator calculates exact sales tax by state, county, city, or zip code.

Source: blog.usgeocoder.com

Source: blog.usgeocoder.com

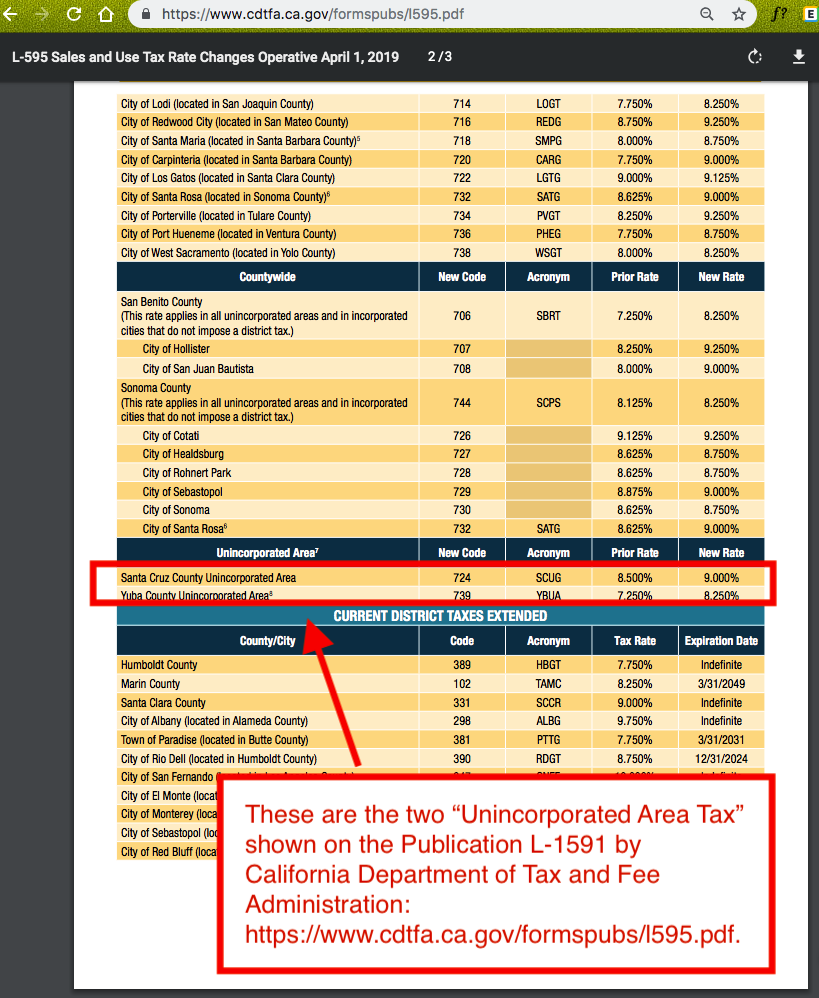

How to Calculate California Unincorporated Area Sales Tax, The current total local sales tax rate in orange, ca is 7.750%. Tax rates are provided by avalara and updated monthly.

Source: printablemapaz.com

Source: printablemapaz.com

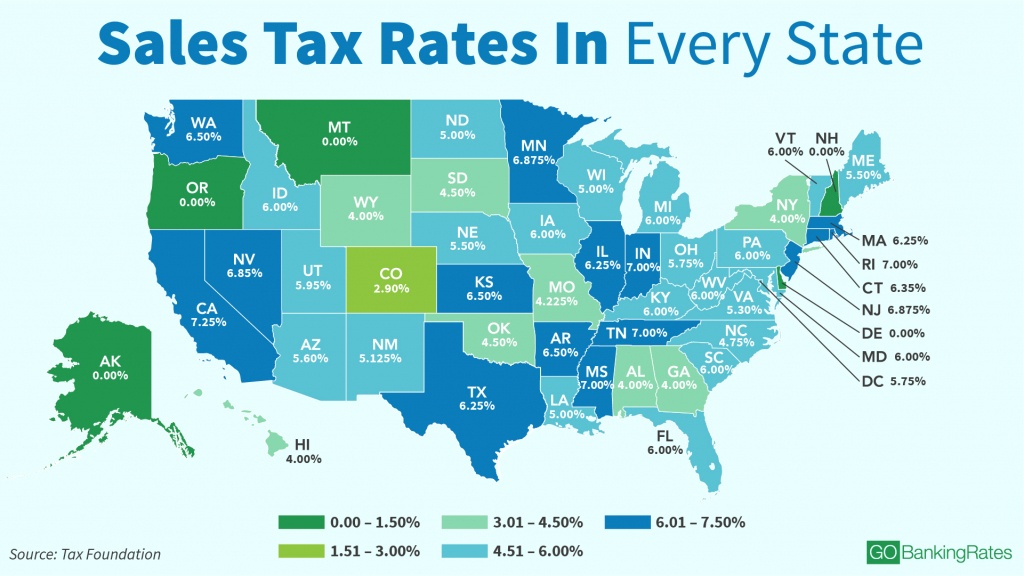

State And Local Sales Tax Rates, 2019 Tax Foundation California, The december 2020 total local sales tax rate was also 7.750%. 81 rows the local sales tax rate in orange county is 0.25%, and the maximum rate.

The Orange County, California Sales Tax Is 7.75%, Consisting Of 6.00% California State Sales Tax And 1.75% Orange County Local Sales Taxes.the Local Sales Tax Consists Of A 0.25%.

The 2024 sales tax rate in irvine is 7.75%, and consists of 6% california state sales tax, 0.25% orange county sales tax and 1.5% special district tax.

Type An Address Above And Click Search To Find The Sales And Use Tax Rate For That Location.

These figures are the sum of the rates together on the state, county, city, and special levels.